2024 Cohort Series

Legal Insights for Church Leaders

Join us for our second year and pose your pressing questions to two renowned legal and financial minds, Frank and Elaine Sommerville, plus learn more about compensation, benevolence, and employment law issues.

Benefit from the Sommerville's decades of ministry experience, as well as the encouragement and insights of leaders and pastors who face many of the same challenges as you. You'll leave equipped, energized, and encouraged to help your church comply with legal and accounting principles—freeing you to focus on God's vision for your church.

What You'll Gain

A half-day virtual gathering offered exclusively to Church Law & Tax Advantage Members, this cohort provides a small group of like-minded individuals in similar positions of responsibility the opportunity to meet and learn from Frank and Elaine Sommerville, two of the country's top legal and financial experts.

You'll discuss and receive key updates on:

• The new US Department of Labor test for classifying independent contractors

• Church mergers and acquisitions

• Expanded church property uses

• Copyright in the AI era

• Succession planning

• Retirement planning.

• Plus much more!

You'll also have plenty of time to ask questions about what your church is facing in the areas of accounting, risk management, or legal issues.

In addition, you will have the valuable opportunity to join Frank and Elaine in a follow-up session scheduled for November. This session will enable you to ask any lingering questions you may have and collaborate on the successful implementation of knowledge you gained.

Our Time Together

Session 1

Orientation

Get to know Frank and Elaine Sommerville, Church Law & Tax's Matthew Branaugh and Rick Spruill, and the other cohorts members.

Session 2

Employment Law Q&A

Dive into topics like compensation, payroll taxes, retirement planning, and housing allowances, plus learn the latest about the U.S. Department of Labor's newly issued rule on classifying workers and independent contractors. Bring your questions--and gain insights you need.

Session 3

Outreach and Ministry Activities Q&A

Take a closer look at missions trips and benevolence programs, and find out more about merger-and-acquisition trends and issues, as well as ways churches are expanding uses of their properties. Find out what these activities mean for your church's legal and risk liabilities.

Session 4

Intellectual Property Q&A

Who owns the minister's sermons? What types of issues do online streaming, video, and podcasting raise? And how does generative artificial intelligence (AI) factor into content your church creates--and what are the copyright implications? Take a closer look at a rapidly evolving--and increasingly relevant--area of law for church leaders.

Session 5

Open Q&A

The conversation continues. Raise lingering questions you have from the earlier sessions- or bring up burning questions you have on any other legal or financial fronts.

Session 6

Closing Thoughts

Debrief with Frank, Elaine, Matthew, and Rick--what did you learn? What do you need more help with? What's on your to-do list between now and November's follow-up session?

About Our Experts

Frank Sommerville, Attorney, CPA

As a board-certified tax law attorney and licensed CPA, Frank has represented nonprofit institutions for over thirty years and has presented seminars on nonprofit taxation since 1981. He has also contributed to PPC’s Nonprofit Tax Governance Guide and has served on the Panel of Legal Experts for Senator Charles Grassley and the Evangelical Council for Financial Accountability’s Commission for Accountability and Policy for Religious Organizations.

When he's not busy helping clients navigate the complexities of tax law, Frank enjoys spending time with his wife Elaine, their children, and grandchildren. They're longtime members of Gospel Lighthouse Church in Dallas, where Frank and Elaine are active in the worship ministry.

Elaine Sommerville, CPA

Elaine L. Sommerville is a certified public accountant in Texas with over 35 years of experience in public accounting. Her practice specializes in tax compliance for nonprofit organizations and churches, and she has worked on large case IRS exams as well as other IRS examinations. Elaine is the author of Church Compensation: From Strategic Plan to Compliance and regularly speaks and teaches on tax planning and compliance for nonprofit organizations. She is the sole shareholder of Sommerville & Associates, P.C., a CPA firm located in Arlington, Texas, which provides tax, accounting, and consulting services to over 300 churches and nonprofit organizations.

Elaine is a member of various professional organizations and serves on the board of Alive at Last, a ministry dedicated to rescuing young women from sex trafficking. She is married with four grandchildren and enjoys spending time with family and going to the beach.

About Our Experts

Frank Sommerville, Attorney, CPA

As a board-certified tax law attorney and licensed CPA, Frank has represented nonprofit institutions for over thirty years and has presented seminars on nonprofit taxation since 1981. He has also contributed to PPC’s Nonprofit Tax Governance Guide and has served on the Panel of Legal Experts for Senator Charles Grassley and the Evangelical Council for Financial Accountability’s Commission for Accountability and Policy for Religious Organizations.

Elaine Sommerville, Attorney, CPA

Elaine L. Sommerville is a certified public accountant in Texas with over 35 years of experience in public accounting. Her practice specializes in tax compliance for nonprofit organizations and churches, and she has worked on large case IRS exams as well as other IRS examinations. Elaine is the author of Church Compensation: From Strategic Plan to Compliance and regularly speaks and teaches on tax planning and compliance for nonprofit organizations. She is the sole shareholder of Sommerville & Associates, P.C., a CPA firm located in Arlington, Texas, which provides tax, accounting, and consulting services to over 300 churches and nonprofit organizations.

What You'll Gain

A virtual half-day session exclusively for Church Law & Tax Advantage members will offer you the opportunity to meet with Frank and Elaine Sommerville, two of the country's top legal and financial minds. In this private cohort, you'll join individuals leading from similar levels of responsibility.

You'll receive and discuss updates on:

• The new US Department of Labor test for classifying independent contractors

• Church mergers and acquisitions

• Expanded church property uses

• Copyright in the AI era

• Succession planning

• Retirement planning.

• Plus much more!

You'll also have plenty of time to ask questions about what your church is facing in the areas of accounting, risk management, or legal issues.

In addition, you will have the valuable opportunity to join Frank and Elaine in a follow-up session scheduled for November. This session will enable you to ask any lingering questions you may have and collaborate on the successful implementation of knowledge you gained.

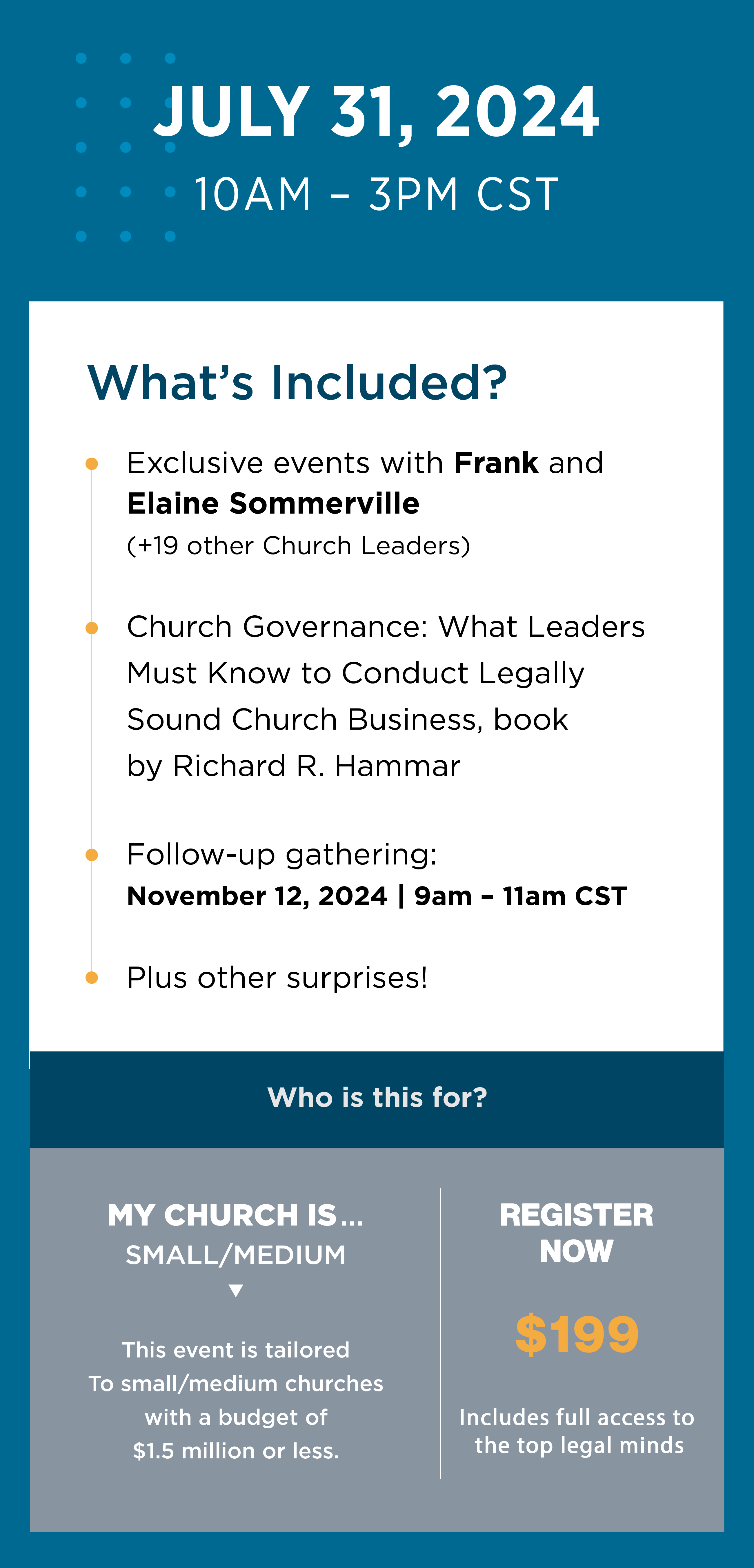

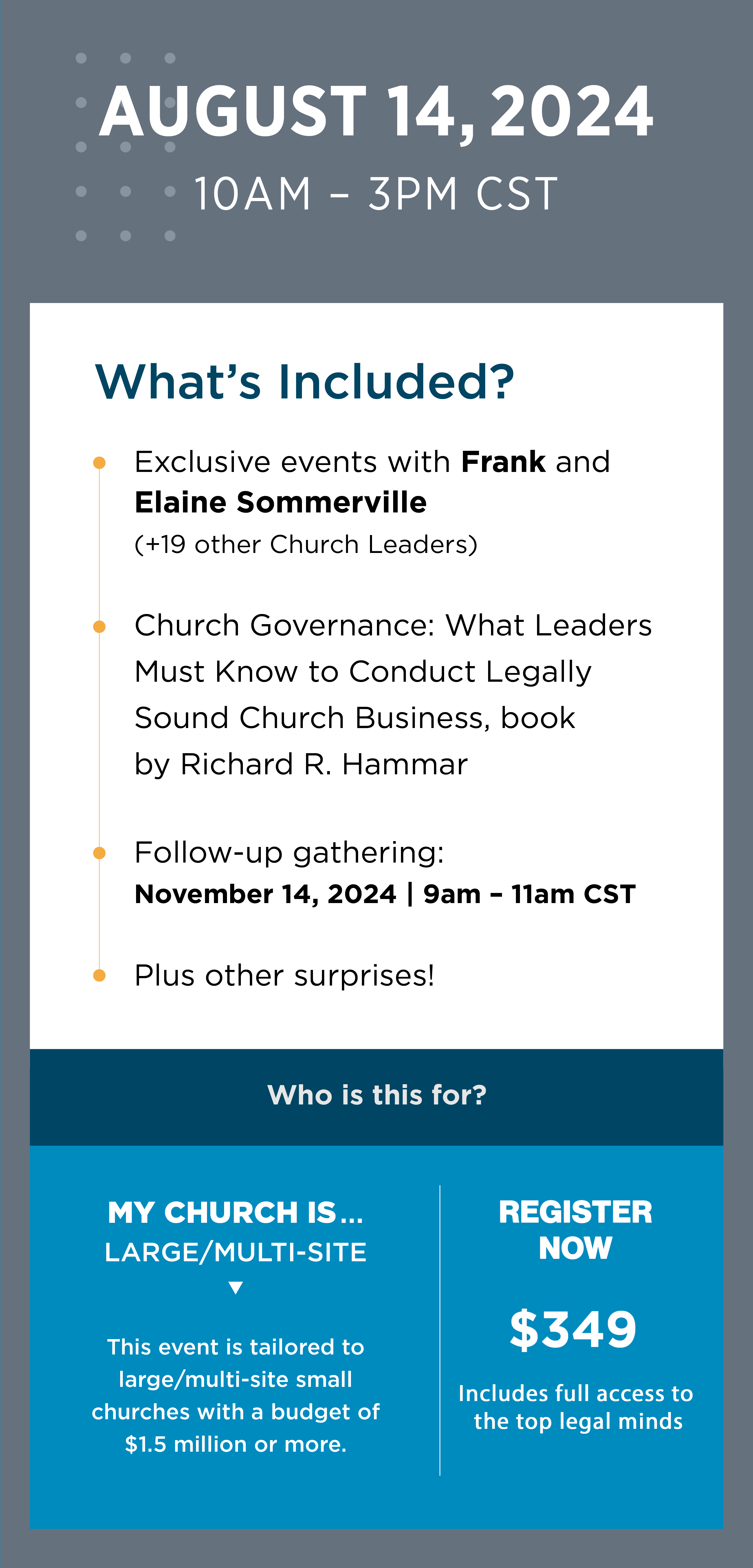

Select Your Date

Don't miss out— all registration ends June 1st!

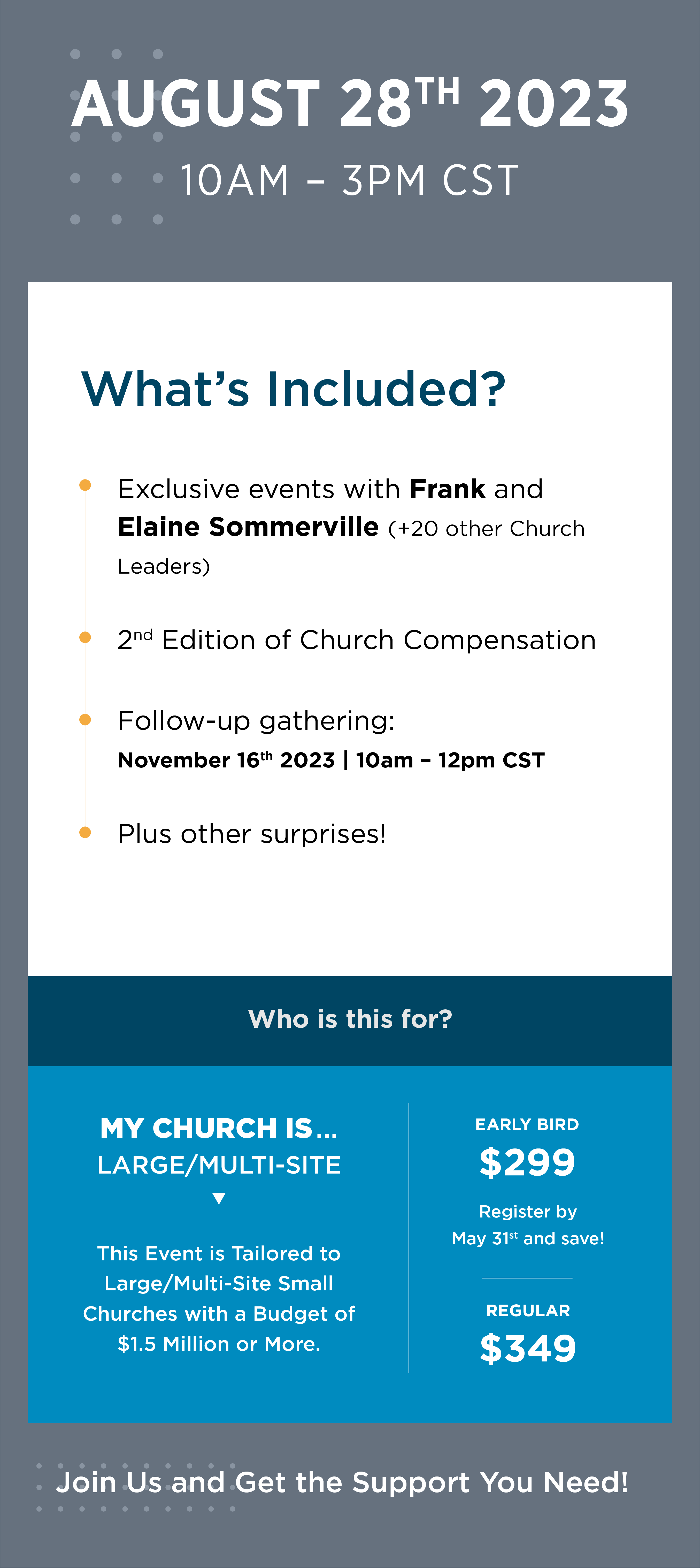

Select Your Date

Take advantage of this limited-time offer. Register by May 1st to get discounted pricing. Don't miss out — registration ends July 1st!

Frequently Asked Questions

Q: When will we receive the Zoom link to the meeting?

A: You will receive a meeting link via email a couple of days prior to the event.

Q: When will we receive our materials (participants guide, etc.)?

A: You’ll receive your Legal Insights for Church Leaders gift box a few days prior to the event.

Q: Can I share my screen with others in my church?

A: Tickets are one per person.

Q: Will there be a break for lunch?

A: There will be no formal break for lunch. You’re welcome to enjoy food and beverages during each session.

Q: What if I can’t attend? Can I get a refund?

A: Fee refund requests must be received by July 15, 2024 for the July 31 event and by July 20, 2024 for the August 14 event.

Q: How do I request a refund?

A: To request a refund please call: 877-247-4787.

Church Law & Tax